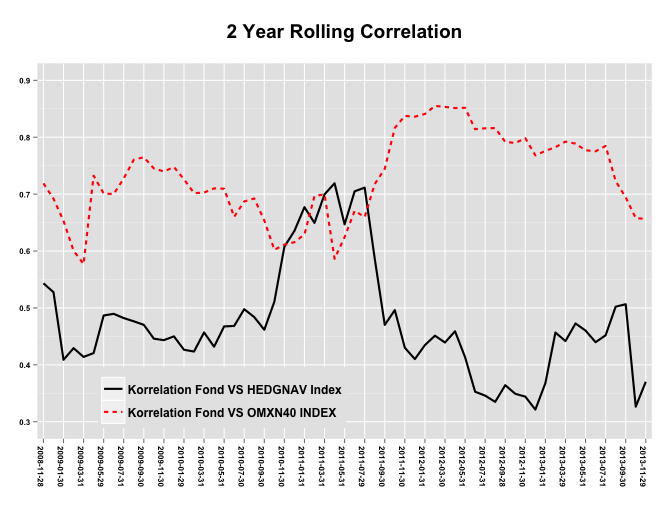

Показать половину значений по оси x с помощью ggplot и scale_x_discrete

У меня есть датафрейм:

dput(df):

structure(list(Date = c("2008-11-28", "2008-12-31", "2009-01-30",

"2009-02-27", "2009-03-31", "2009-04-30", "2009-05-29", "2009-06-30",

"2009-07-31", "2009-08-31", "2009-09-30", "2009-10-30", "2009-11-30",

"2009-12-31", "2010-01-29", "2010-02-26", "2010-03-31", "2010-04-30",

"2010-05-31", "2010-06-30", "2010-07-30", "2010-08-31", "2010-09-30",

"2010-10-29", "2010-11-30", "2010-12-31", "2011-01-31", "2011-02-28",

"2011-03-31", "2011-04-29", "2011-05-31", "2011-06-30", "2011-07-29",

"2011-08-31", "2011-09-30", "2011-10-31", "2011-11-30", "2011-12-30",

"2012-01-31", "2012-02-29", "2012-03-30", "2012-04-30", "2012-05-31",

"2012-06-29", "2012-07-31", "2012-08-31", "2012-09-28", "2012-10-31",

"2012-11-30", "2012-12-31", "2013-01-31", "2013-02-28", "2013-03-29",

"2013-04-30", "2013-05-31", "2013-06-28", "2013-07-31", "2013-08-30",

"2013-09-30", "2013-10-31", "2013-11-29", "2008-11-28", "2008-12-31",

"2009-01-30", "2009-02-27", "2009-03-31", "2009-04-30", "2009-05-29",

"2009-06-30", "2009-07-31", "2009-08-31", "2009-09-30", "2009-10-30",

"2009-11-30", "2009-12-31", "2010-01-29", "2010-02-26", "2010-03-31",

"2010-04-30", "2010-05-31", "2010-06-30", "2010-07-30", "2010-08-31",

"2010-09-30", "2010-10-29", "2010-11-30", "2010-12-31", "2011-01-31",

"2011-02-28", "2011-03-31", "2011-04-29", "2011-05-31", "2011-06-30",

"2011-07-29", "2011-08-31", "2011-09-30", "2011-10-31", "2011-11-30",

"2011-12-30", "2012-01-31", "2012-02-29", "2012-03-30", "2012-04-30",

"2012-05-31", "2012-06-29", "2012-07-31", "2012-08-31", "2012-09-28",

"2012-10-31", "2012-11-30", "2012-12-31", "2013-01-31", "2013-02-28",

"2013-03-29", "2013-04-30", "2013-05-31", "2013-06-28", "2013-07-31",

"2013-08-30", "2013-09-30", "2013-10-31", "2013-11-29"), Variables = c("Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS HEDGNAV Index", "Korrelation Fond VS HEDGNAV Index",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX", "Korrelation Fond VS OMXN40 INDEX",

"Korrelation Fond VS OMXN40 INDEX"), Value = c(0.543281082364437,

0.527712775086864, 0.408808506706841, 0.429295911936136, 0.413869805084106,

0.420679623586744, 0.486699140272165, 0.489646951704357, 0.482167209693269,

0.476479729549409, 0.470318758286474, 0.445944951970354, 0.443399322259001,

0.450016066763416, 0.426480550286595, 0.423371569969272, 0.45695040799057,

0.431834238396871, 0.467511327603749, 0.468313995662446, 0.497800239085846,

0.483892272485929, 0.461639835904741, 0.510817807699252, 0.607556423633874,

0.635324016630525, 0.677123446245495, 0.64944374391215, 0.699596537117267,

0.719111914210672, 0.646823640421409, 0.704957947272873, 0.711475445475265,

0.586745307486821, 0.470189153059282, 0.496157837064293, 0.42998988517485,

0.410086396037883, 0.434712079537519, 0.451209820436262, 0.439204849230259,

0.458968925612488, 0.413432511226888, 0.352720907440874, 0.345869742666471,

0.334881763959464, 0.364193270299568, 0.349099808200996, 0.344120170458358,

0.321312279605764, 0.36780909986839, 0.45673262559758, 0.441745479560392,

0.472657754486699, 0.460230404194416, 0.439767509233639, 0.451917786933249,

0.502203230669925, 0.506491068871301, 0.326404602073815, 0.370217685029334,

0.718957249305725, 0.692112042544696, 0.653190037272512, 0.600562794023062,

0.577038569091474, 0.732404727204883, 0.701073092028334, 0.70024367927988,

0.72760615710821, 0.760476468119078, 0.76494346961595, 0.74516226659605,

0.739882810581542, 0.747631786072444, 0.726091015017154, 0.701735263628067,

0.702742836045239, 0.710111045287843, 0.709534887923479, 0.660085062138124,

0.68714771636425, 0.692372537364393, 0.653723068520449, 0.60219048444321,

0.611238847460719, 0.615532490318692, 0.629099995821728, 0.696641041953563,

0.699678945834638, 0.586283865406429, 0.624290876602801, 0.670695507419494,

0.659774721518298, 0.71774709033755, 0.744569380783438, 0.816379470202153,

0.837499193100422, 0.836198005977033, 0.84080909869627, 0.855061699261408,

0.853368178821269, 0.851320045495211, 0.851777606811136, 0.814170256202011,

0.815730122501554, 0.816104542127919, 0.791916561887601, 0.789829046533777,

0.798421955468353, 0.768092583652463, 0.775993885935737, 0.782511954882627,

0.792300623324247, 0.788792623730908, 0.777178875667974, 0.77530100406966,

0.784668152948575, 0.723029746336548, 0.694308712557347, 0.657753481204441,

0.656521122619321)), .Names = c("Date", "Variables", "Value"), row.names = c(NA,

-122L), class = "data.frame")

Затем я использую ggplot:

CorrelationsBenchPlot<-ggplot(corres24mDfMelt, aes(x=Date,y=Value,group=Variables))+

geom_line(aes(linetype=Variables,colour=Variables), size=1)+

scale_y_continuous(breaks=seq(0.3,0.9,0.1),limits=c(0.3,0.9))+

scale_x_discrete(breaks = corres24mDfMelt$Date[c(TRUE,FALSE)])+

scale_colour_manual(values=c("black", "red", "green"))+theme_gdocs()+

theme(axis.text.x = element_text(angle=-90, hjust=0.5, size=8,colour="black",face="bold"),

axis.text.y = element_text(size=8,colour="black",face="bold"),

legend.text = element_text(colour="black", size = 12, face = "bold"),

legend.background = element_rect(fill="gray90", size=.5, linetype="dotted"),

plot.title = element_text(size = rel(1.6),face = "bold"),

axis.title.y = element_blank(),

axis.title.x=element_blank(),

legend.title=element_blank(),

legend.position=c(0.3, 0.11),

legend.position="none",

legend.box="vertical")+

labs(title = "2 Year Rolling Correlation\n")

Поэтому я хочу показать каждое второе символьное значение на оси х, используя scale_x_discrete(breaks = corres24mDfMelt$Date[c(TRUE,FALSE)]), но это не работает, и я получаю все значения оси X.

Что я делаю неправильно?

С уважением!

1 ответ

Решение

Значения в corres24mDfMelt$Date не являются уникальными, но дублируются (у вас есть два значения на дату). Следовательно, команда corres24mDfMelt$Date[c(TRUE,FALSE)] по-прежнему возвращает все возможные значения.

Вы должны использовать unique даты в качестве основы:

scale_x_discrete(breaks = unique(corres24mDfMelt$Date)[c(TRUE,FALSE)])